UNCED or Earth Summit 1992, Rio De Janeiro, Brazil

Follow-up to UNCED

Q. What

is Rio+20 Conference, often mentioned in the news?UPSC pre-2015

a) It is the United Nations Conference on Sustainable

Development

b) It is a Ministerial Meeting of the World Trade

Organization

c) It is a Conference of the Inter-governmental Panel on

Climate Change

d) It is a Conference of the Member Countries of the

Convention on Biological Diversity

Tip - This question show that basic information like official name can also be asked.

Answer: a)

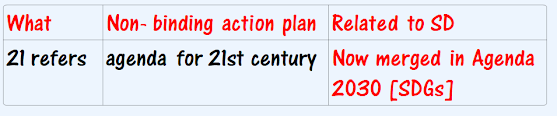

UN Agenda 21

Q. With reference to ‘Agenda

21’, sometimes seen in the news, consider the following statements: (2016)

1)

It is a global action plan for sustainable development

2)

It originated in the World Summit on Sustainable Development

held

in Johannesburg in 2002.

Which

of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

Solution

A

Landmark Agreement

1.UNFCCC[Framework convention on climate

change]----which in turn led to the Kyoto Protocol & Paris Agreement.

2. Convention

on Biological Diversity (CBD)

3.

United Nations Convention to Combat Desertification (UNCCD)

Note

- All the 3 are legally binding

Source

-

CBD

But

as per UK government official website

The

United Nations Framework Convention on Climate Change (UNFCCC) is an

international treaty adopted in 1992 by the majority of the world's countries.

The

treaty is not legally binding, but provides opportunities for updates

(protocols) that can be used to set legally binding emissions limits.

Eg-

Kyoto protocol

To

me it sounds correct but if a question come then its Upto UPSC which source

they refer.

High-level Political Forum on

Sustainable Development (HLPF)

.PNG)

Comments

Post a Comment